How Has Car Rental Distribution Evolved in the Digital Age?

The car rental distribution landscape has undergone a dramatic transformation, shifting from traditional travel agency bookings to a complex, multi-channel ecosystem dominated by digital platforms. According to recent data from Phocuswright, digital channels now account for 78% of all car rental bookings globally in 2024, up from 65% in 2020. This evolution has created both challenges and opportunities for car rental companies seeking to optimize their distribution strategy, reduce acquisition costs, and maintain control of their customer relationships.

Which Distribution Channels Drive the Highest Volume in 2024-2025?

- Direct digital channels (company websites and apps) now represent 42% of all bookings in 2024, up from 35% in 2022.

- Online Travel Agencies (OTAs) account for 31% of bookings but command higher commission rates (18-25% on average).

- Metasearch engines drive 15% of bookings through price comparison and referral traffic.

- Traditional travel agencies have declined to just 8% of total bookings but remain important for corporate accounts.

- Airline and hotel partnerships generate 4% of bookings through cross-selling opportunities.

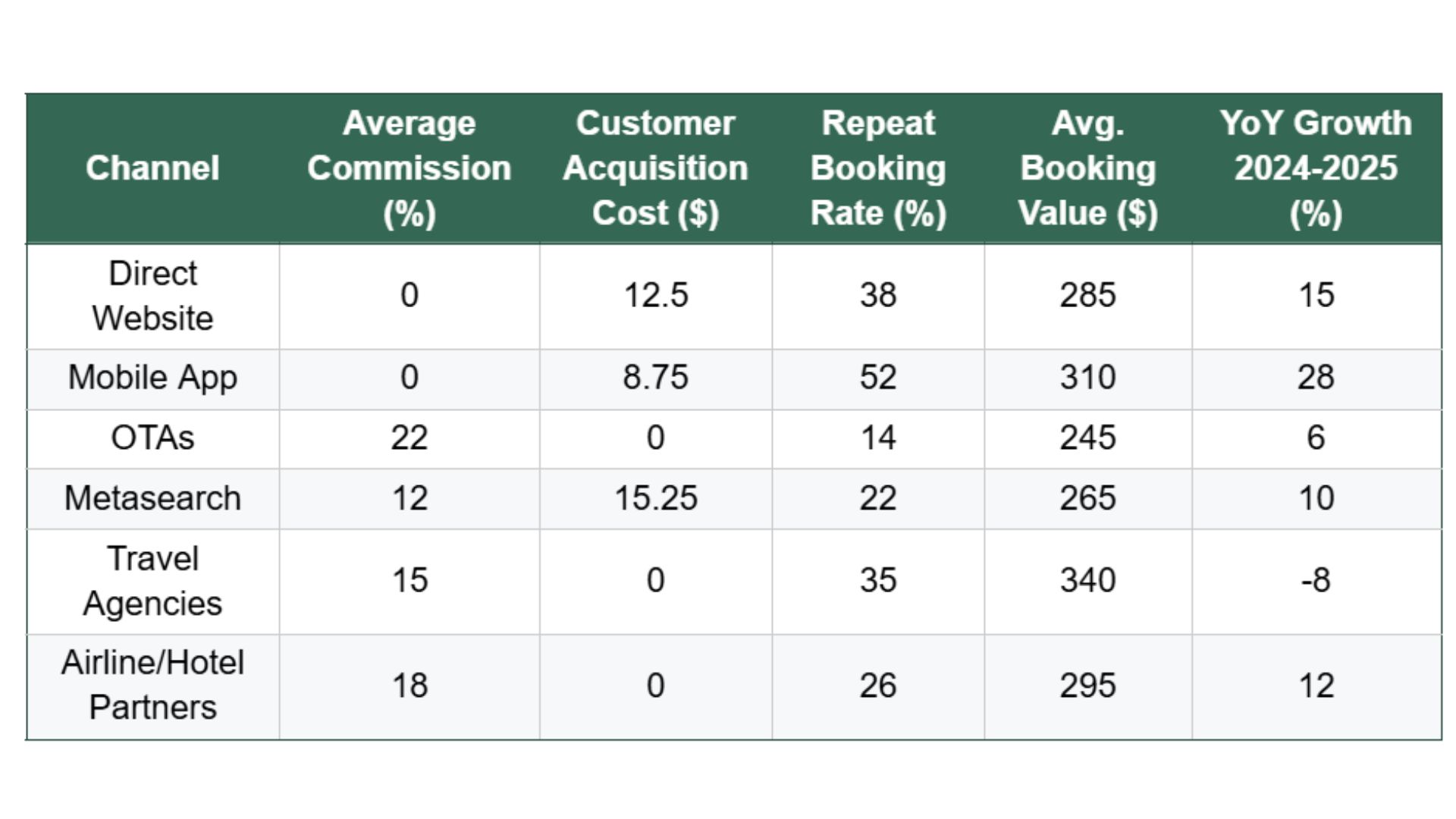

What Are the Cost Implications of Different Distribution Channels?

Sources: Rental Car Industry Report, McKinsey Travel Analytics, 2024-2025

How Are Mobile Apps Transforming the Rental Experience?

- In-app features driving adoption include:

- Digital vehicle selection and upgrades

- Contactless pickup and return processes

- Real-time fleet availability and location tracking

- Personalized offers based on user behavior

- Loyalty program integration and point redemption

- Mobile app bookings have grown by 28% year-over-year in 2024-2025.

- Customer retention rates are 52% higher for app users compared to website customers.

- Average booking value is $25 higher through mobile apps versus other channels.

- Push notifications have proven effective, with 32% conversion rates for targeted upgrade offers.

What Strategies Are Working for OTA and Metasearch Management?

- Rate parity management tools are used by 76% of major rental companies to monitor and enforce pricing consistency.

- Limited inventory allocation strategies reserve premium vehicles for direct channels.

- Opaque pricing models (through Hotwire, Priceline) help move excess inventory without undermining public rates.

- Metasearch bidding optimization focuses on high-value routes and locations with better conversion rates.

- Commission negotiation based on volume and performance metrics has reduced average OTA costs by 2.5% since 2023.

- API connectivity improvements have reduced technical issues by 45% and improved conversion rates.

What Role Do Traditional Travel Agencies Still Play?

- Corporate travel accounts still book 65% of their rentals through TMCs (Travel Management Companies).

- High-value international rentals show 22% higher average daily rates when booked through agencies.

- Package bookings (flight + hotel + car) remain popular through traditional channels for certain demographics.

- Specialized service requirements (chauffeur, luxury vehicles, one-way international) often leverage agency expertise.

- Commission structures have evolved to performance-based models with tiered rates based on volume.

How Are Emerging Technologies Reshaping Distribution in 2025?

- Voice-activated booking through smart assistants is projected to handle 8% of reservations by the end of 2025.

- Connected car technology enables direct booking through in-vehicle systems in newer models.

- Blockchain-based distribution is being tested by major companies to reduce intermediary costs.

- Super-apps combining transportation options (ride-hailing, car-sharing, traditional rentals) are gaining traction.

- AI-powered personalization engines are delivering 18% higher conversion rates on direct channels.

- Subscription models are creating new distribution challenges and opportunities outside traditional booking flows.

Conclusion: What Should Be the Focus of a Balanced Distribution Strategy?

- Prioritize direct channel growth through enhanced digital experiences and loyalty incentives.

- Maintain strategic OTA relationships while carefully managing rate parity and inventory allocation.

- Invest in mobile app development as the highest-ROI digital channel with superior customer retention.

- Leverage data across all channels to create a unified customer view and personalized marketing approach.

- Continuously evaluate channel costs against lifetime customer value rather than just acquisition metrics.